foreign gift tax india

In addition gifts from foreign corporations or partnerships are subject to a. Once the aggregate value of gifts received during the year exceeds Rs.

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

The penalty for not reporting a foreign giftinheritance that must be reported is 5 percent of the amount of the gift for each month the failure to report continues up to a.

. 5 TCS on foreign remittances under LRS or outward remittance exceeding Rs 7 lakh. Again it is simply a declaration. 5 TCS on the total amount for the purchase of an overseas tour package no Rs 7 lakh.

The said Act was introduced to impose taxation on the exchange of. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax Research Platform. For purported gifts from foreign corporations or foreign partnerships you are required.

50000 then all gifts are charged to tax Sum. As per the new provisions any sum of money received on or after. While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds.

One exception which is likely to arise is if youre sending money to India as a gift. If you happen to receive money from a foreign corporation or partnership as a gift and it is above. There is no inheritance tax in India.

1 gifts up to rs 50000 in a financial year are exempt from tax. The TT employee missed the foreign part but this is also a two. However gift of money received in India from his friends or non.

A 5 tcs has been imposed on all foreign tour packages and other foreign remittances done under the liberalized remittance scheme lrs that exceeds rs 7 lakh in a financial year. What is Gift Tax in India. Part then gifts whether received from India or abroad will be charged to tax.

Part then gifts whether received from India or abroad will be charged to tax. Estate Gift Tax Treaties International US. If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000.

In this case the recipient in India may need to report the gift and pay tax on it at the prevailing. You will not have to pay tax on this though. The Indian government introduced the tax on gifts in April 1958 and the Gift Tax Act regulates it.

Also gifts received outside India from foreign friends will not be taxable in India as Ayush is a Non-Resident. The Indian government introduced the tax on gifts in April 1958 and the Gift Tax Act regulates it.

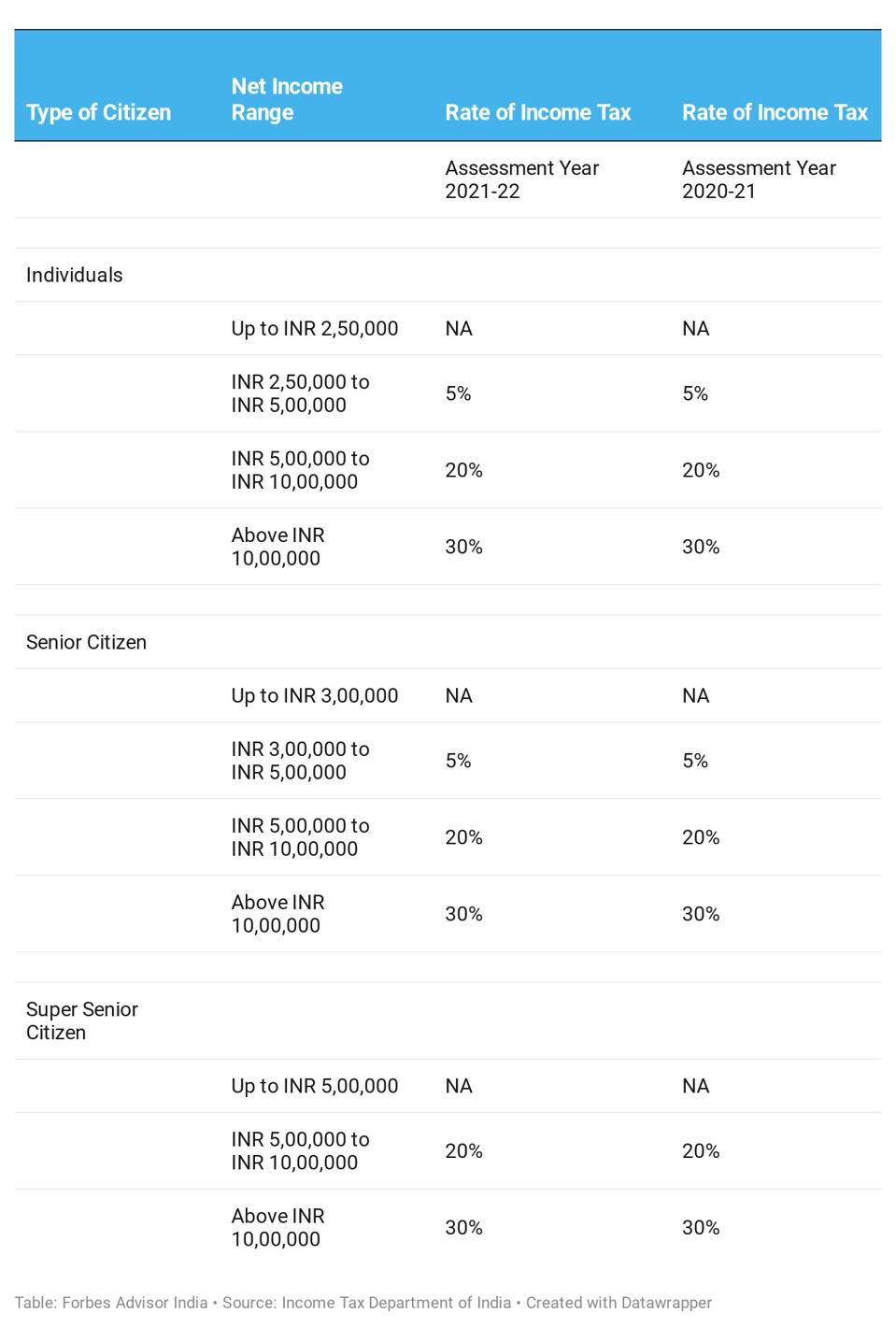

Know Types Of Direct Tax And Charges Forbes Advisor India

Must I Pay Taxes On An Inheritance From Foreign Relative

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Gift By Nri To Resident Indian Or Vice Versa Nri Gift Tax In India

Tax Accounting Xperts Ilead Tax Llc

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What The Ifsc At Gift City Has For Non Resident Indian Investors Times Of Up

An Nri Buys House In Resident Country Should This Be Disclosed In India Itr Mint

Gift From Nri Dad Not Taxable But You Have To Pay Tax On Income From It The Financial Express

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Income Tax Implications On Rsus Or Espps

Property Sale By Nri In India Tax Tds Rebate Repatriation Rbi Approval

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

5 Rules About Income Tax On Gifts Received In India Exemptions

Nri Selling Inherited Property In India Tax Implications 2022 Sbnri

Non Citizens And Us Tax Residency Expat Tax Professionals

Is There Any Restriction Of Amount That Can Be Sent To Nre Account In India From Us Quora

Property Sale By Nri In India Tax Tds Rebate Repatriation Rbi Approval